Home - Services - Unsecured Business Loans

Formation Finance provides unsecured business loans from $5K to $5M in 24 hours with zero collateral, zero red tape.

Get fast access to up to $5M to keep your business moving. Apply in 5 minutes with minimal paperwork and funding possible in hours.

Guidelines only. Final terms depend on lender assessment, documents, and suitability.

| Unsecured Term Loan | Business Line of Credit | Invoice Finance (if applicable) | Revenue Based Finance (if applicable) | |

|---|---|---|---|---|

| Loan amount (guide) | $5K–$5M (subject to approval) | Up to $750K (subject to approval) | Based on eligible invoices | Based on trading revenue |

| Term / structure | 3–36 months (fixed schedule) | Revolving limit (draw and repay) | Advance against invoices | Repayments linked to revenue |

| Funding speed (guide) | As fast as same day / 24 hours | Fast access once approved | Fast after setup | Fast after assessment |

| Security | Generally no property security | Generally no property security | Typically invoices as security | Typically no property security |

| Best for | Lump sum working capital, stock, one off costs | Cash flow buffer, ongoing gaps, flexible drawdowns | Businesses with B2B invoicing cycles | Businesses with stable card or daily sales |

| Documents (common) | ABN details + bank statements | ABN details + bank statements | Invoices + debtor info + bank statements | Bank statements + sales data |

Note: Timeframes and limits vary by lender, credit assessment, and document completeness.

We’re committed to saying “yes” more often. To qualify for a Fast Business Loan, you’ll need:

We’re committed to saying “yes” more often. To qualify for a Fast Business Loan, you’ll need:

Fees and pricing vary by lender and are confirmed before you accept an offer. Typical costs may include an establishment fee and ongoing interest or service fees. Repayment schedules depend on cash flow and product type. Always review the total repayment amount, repayment frequency, and any early payout conditions before proceeding.

We have established minimum eligibility criteria to ensure that our business loans are accessible to a broad range of businesses.

To qualify for our unsecured business loans, you’ll need to meet the following requirements:

An active ABN (Australian Business Number): This confirms that your business is legally registered and operating in Australia.

At least 4 months of trading history: This allows us to evaluate your business’s stability and growth potential.

A minimum monthly revenue of $12,000: This ensures we can provide a loan amount that aligns with your financial capacity and repayment ability.

If you meet these criteria, you’re eligible to apply for a fast business loan. Our financing solutions are designed to support growing businesses, giving you quick access to the funds you need to thrive.

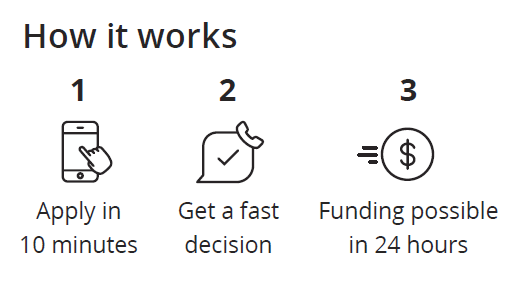

Applying for unsecured business loans is simple and hassle-free. Complete our online application in just 10 minutes, following these 3 simple steps:

We understand that speed matters when it comes to fast business loans. In most cases, loans can be approved within 3 business hours.

For approved applications submitted before 4 PM on a business day, funds can be deposited as soon as the next business day—helping you access the cash flow you need without delays.

Formation Finance procures business loans of $5,000 to $5,000,000 and Lines of Credit up to $750,000.

The amount you can borrow through our unsecured business loans depends on key factors such as your business’s cash flow, trading history, industry, assets, and loan purpose.

Our goal is to provide fast business loans tailored to your specific financial needs, reducing risk while supporting your business’s long-term growth. By analyzing the health of your business, we determine the most suitable loan amount and terms—helping you secure funding that fuels success.

Our unsecured business loans give you the flexibility to use the funds however your business needs. Many of our customers use their fast business loans for:

Business expansion, renovations, and unexpected repairs

Purchasing stock, inventory, and equipment

Marketing and advertising campaigns

Hiring new employees

Covering operational expenses and business investments

Managing cash flow and fueling business growth

Whatever your business goals, our funding solutions are designed to help you move forward with confidence.

With our unsecured business loans, you’ll always know exactly how much you need to repay from day one. There are no hidden fees, no compounding interest, and no additional charges (as long as you make your repayments on time).

Not all applicants will qualify for the same loan terms, rates, or amounts, as each business is assessed individually. Interest rates vary due to factors including the amount borrowed, the industry the business operates in, how long the business has been running, whether the business has sufficient cash flow to support the loan, and the overall ‘health’ or creditworthiness of the business.

Unlike many other lenders, we don’t penalize you for repaying your unsecured business loan early. In fact, we reward you! If you choose to pay off your fast business loan ahead of schedule, you’ll receive a discount—helping you save on costs while maintaining financial flexibility.

Take control of your business funding with a loan that works in your favor!