Property Development Loans in Australia: A Practical Guide to Property Development Finance

Property development is capital heavy. The structure of your funding can determine whether a project delivers strong returns or simply absorbs equity. In Australia, property development loans are specialised facilities designed to fund land acquisition, construction and project delivery. They are assessed on feasibility, risk and exit strategy which is not just borrower income. Understanding […]

Alternative Funding: A Comprehensive Guide to Securing Private Loan from Private Lender

In the fast-paced realm of property development and investment, time is money. Securing quick and flexible funding is paramount for success. Traditional lending institutions, banks may present challenges with their protracted approval processes and stringent criteria, prompting savvy property developers and investors to explore alternative avenues such as obtaining a private mortgage from a private […]

The stages of property development finance – what lenders look for at each step

Property development funding isn’t one-size-fits-all.At every stage of the project, lenders focus on different risks – and getting finance approved depends on knowing exactly what they care about. Here’s the journey of Property Development Finance 👇 🔹 LandbankLenders check: Did you acquire at the right price? Planning potential of the site Sponsor strength & track […]

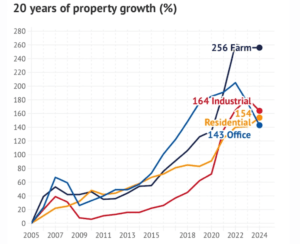

Which Property Investment Type Has Performed Best in Australia Over the Past 20 Years?

If you had to guess which property sector delivered the strongest returns in Australia over the past two decades — would you say residential? Maybe industrial? Most people guess wrong. Here’s what the data from 2005 to 2025 shows about long-term property performance: 🥇 1. Agricultural Land ✅ Total Growth: 256% ✅ Annualised Return: ~6.7%Quietly […]

What Is A No-Doc Loan In Australia?

Think of this: you work for yourself, your cash flow is not steady, and figuring out taxes is a huge mess. When you try to get a loan from a normal lender, they want two years of tax details, pay slips you don’t have, and loads of old financial papers. For many in Australia, this […]

What is Private Lending, and Can It Be Right for You?

In the world of money, getting a loan is not just from big banks or other big lenders anymore. More people in Australia now look at different ways to get money when the usual ways don’t work. A choice that is getting popular is private lending, used for business and investing. But what is private […]

Get Money Fast: How to Get a Private Loan from a Private Lender

Intro In real estate development and investment, fast cash is key. Getting money quickly and with ease is vital for success. Big banks often make it hard with their slow approval process and tough rules. Smart developers and investors thus look for other paths, like getting a private loan from a private person. This guide […]

Sydney Top School Zones Property Prices

We have collected and compiled comprehensive property data for the top 10 school zones in Sydney (excluding elite schools with entrance exams). This data includes vacancy rates, median prices, rents, rental yields, etc. Starting with the entry-level options, Sefton, located 24 kilometers from the CBD, ranks 9th with a median house price of only $1.05 […]

Rents continue to increase in 2024

In 2023, the average rent in Australia increased by 15%, and it is expected to continue rising by 7-10% in 2024. Perth are to experience the highest increase of 12-15%, while Brisbane and Sydney 7-10%, and Melbourne 6-9%. The reasons for the rent increases are not hard to explain: Australia’s population grew by 560,000 people in […]

2024 Property Finance Outlook: Cutting Towards Positivity

2023 has been a year full of challenges (and opportunities). As we approach end of the year, Formation Finance Partners would like to thank you for your ongoing support. Looking ahead into 2024, we see strong positivity in the property and lending markets for three key reasons. 1) Strong property fundamentals All states and territories […]