Property development funding isn’t one-size-fits-all.

At every stage of the project, lenders focus on different risks – and getting finance approved depends on knowing exactly what they care about.

Here’s the journey of Property Development Finance 👇

🔹 Landbank

Lenders check:

-

Did you acquire at the right price?

-

Planning potential of the site

-

Sponsor strength & track record

-

Holding costs, gearing levels

-

Clear pathway to DA approval

🔹 DA Approved

With approval in place, value lifts – but lenders will test:

-

Quality of the DA and conditions attached

-

Developer’s ability to execute

-

Transition plan into construction funding

🔹 Construction

The riskiest stage for lenders 💰:

-

Builder capability & fixed-price contracts

-

QS reporting and contingency

-

Presales (if required)

-

Most importantly: your exit strategy (settlements or residual stock loans)

🔹 Residual Stock

Completed project, now it’s all about sales risk:

-

Debt coverage & sales velocity

-

Market demand

-

Credible plan for sell-down or refinance

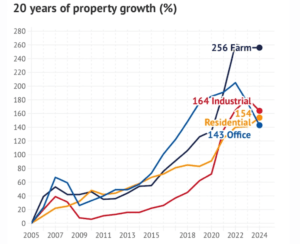

🔹 Term Debt / Investment

Stabilised assets are judged on income security:

-

Tenant strength & lease covenants

-

WALE (weighted average lease expiry)

-

Serviceability metrics (ICR / LVR)

-

Clear path: long-term hold or investment sale

💡 Key takeaway

Different stage → different risk → different pricing.

A strong broker doesn’t just arrange finance for today, they map the whole journey – anticipating what lenders need and making sure the capital stack fits where your project is heading, not just where it stands now.